Financial Planning is the most important aspect of our daily life. Before starting any trip, most of us decide our destination and plan our route very carefully. Sure, there may be detours, but we stick to the general route to get to the destination. Investing is no different. You need financial planning before you start your investment journey to fulfill your dreams or goals. Sure there will be bumps and detours (market volatility) in your investment journey as well. But if you follow your financial plan, you will be better placed to manage all challenges.

In this blog, we will understand key details of financial planning, its importance, and its benefits. We will also explain the steps to go about financial planning and create your own financial plan to achieve all your goals.

What Is Financial Planning?

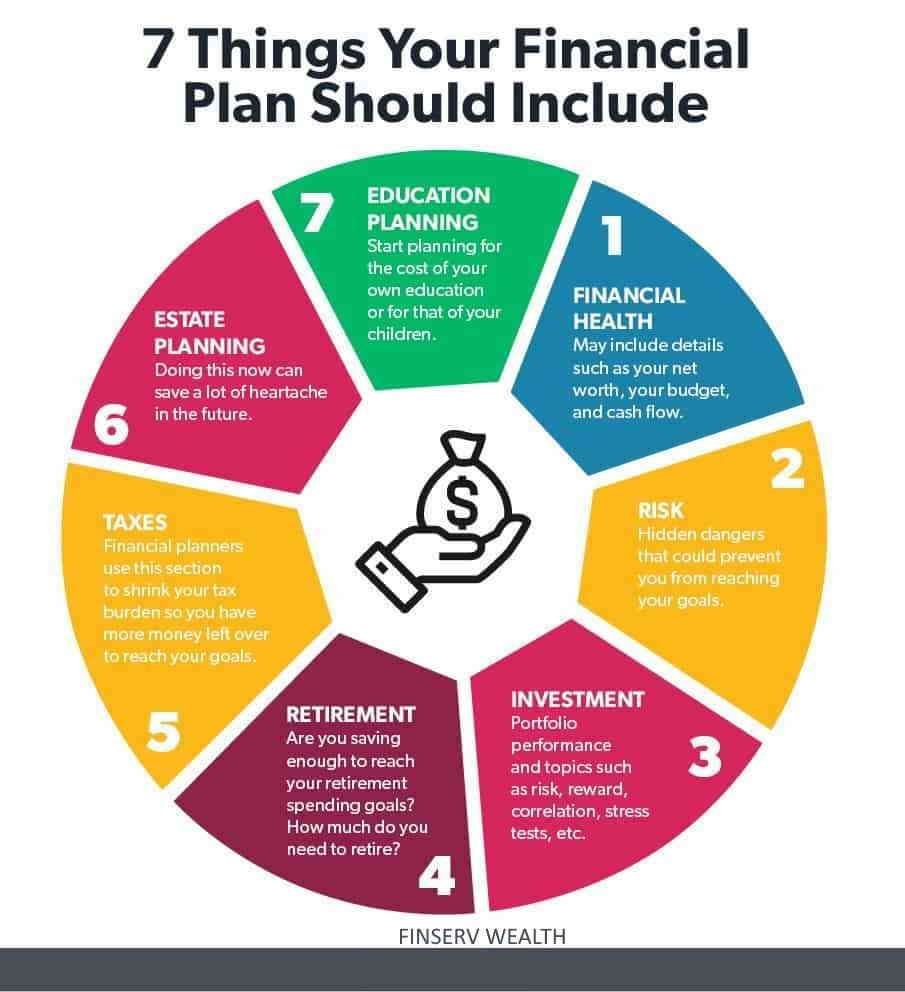

Financial planning is the process that helps you navigate in the right direction to achieve all your life goals. With a financial plan in place, you are more likely to utilize your financial resources efficiently and fulfill your dreams. For instance, financial planning includes deciding your goals, choosing appropriate investment products to achieve the goals, planning the exit strategy, planning for your taxes, becoming debt-free, creating an emergency corpus to deal with rainy days, etc.

Simply put, financial planning helps you keep your finances in control in such a way that you can achieve all your goals and desires. To understand more about financial planning, let’s take a closer look at its importance and benefits.

Financial Planning: Importance And Benefits

All of us have a long list of things that we want to do with our money. This could include saving tax, buying the latest smartphone, laptop, car, properties, saving for children’s education, retirement planning, and so on.

However, more often than not the money we have with us is inadequate to fulfil all our goals. So, it becomes crucial to be clear about our priorities. And to that end, financial planning can come in handy.

The importance of financial planning is that it provides direction to our goals. Financial planning helps you understand your goals better in terms of why you need to achieve these goals and how they impact other aspects of your life and finances. Moreover, financial planning also brings benefits like a smoother transition into different life stages, staying prepared for emergencies, better tax planning, etc.

Let’s look at the benefits of financial planning in detail.

Smoother Transition Into Different Life Stages

Our priorities and responsibilities keep changing when we move from one life stage to the other. Financial planning helps us figure out how we can manage our finances at different stages of life such as bachelor days, married life, post-retirement life, etc.

Helps Stay Prepared For Emergency

Creating an emergency fund is a critical aspect of financial planning. With an emergency fund, you ensure that you have enough corpus that can help you survive for at least 9-12 months of your monthly expenses. This way, you don’t have to worry about money in case of any family emergencies, pay cuts, or job loss.

Helps In Calculating The Right Insurance Cover

Term insurance and health insurance are extremely useful in the case of unfortunate demise and a health emergency, respectively. But what is important is to take the right insurance cover. A financial plan will take into consideration multiple factors like your income, expenses, loans, responsibilities, etc. and help you decide the right insurance cover.

Better Tax Planning

Many of us pay a substantial amount of our salary as tax. But there are legal ways to lower the tax outgo. In fact, the Indian Income Tax Act provides various investment options to build wealth with the saved tax. But most of the time people make the mistake of making tax-saving investments that are not in line with their goals. It happens because they do not consider tax planning to be a part of a financial plan. By planning your taxes in advance, you can identify suitable tax-saving products, reduce your taxable income and build wealth for the long term.

Attain Peace Of Mind

Financial planning takes care of many moving pieces of your finances. You have adequate funds to manage your money. There is insurance to deal with unfortunate events. And you have a plan in hand to achieve long-term and medium-term goals. All these things give you the much-required peace of mind as you are managing your money efficiently.

Now that we know the importance and benefits of financial planning, let’s understand the steps of financial planning with examples.

4 Key Steps Of Successful Financial Planning

To help you get started with financial planning, let’s take a look at the key steps involved in the process. We will describe in brief what these steps are and then explain them with an example.

Step 1 – Set SMART Goals

This step in financial planning involves defining your financial goals. And while you do it, you have to be SMART (Specific, Measurable, Attainable, Relevant, and Time bound). For example, just saying that you will retire rich is not a SMART goal. But accumulating Rs. 5 crore for post-retirement life by the age of 60 is a SMART goal.

When you write down goals this way, it helps you prioritize the most important goals in your life. You also become realistic about your goals and work vigorously to achieve them.

Take for example the above goal of accumulating Rs. 5 crores by the age of 60. Say, the person is 35 years old. So he has 25 years to achieve this target. Now, all he needs to find out is how much he has to invest and what kind of returns he needs to earn.

Here is a table that explores various possibilities to reach the target of Rs. 5 crore in 25 years:

| Required Rate Of Return | Monthly Investment Amount Required |

| 7% | Rs.52,500 |

| 10% | Rs.37,500 |

| 12% | Rs.26,500 |

Step 2 – Budget Your Expenses

To ensure that you get to your goals securely, you have to invest as much as possible. It will be possible only when you cut down on discretionary spending or avoidable expenses and use those savings to invest more.

Step 3 – Find Out Where To Invest

This step involves figuring out where to invest. For instance, if you are investing for long-term goals you can invest in equities, whereas for short-term goals, you can invest in low-risk products like fixed deposits or Debt Funds.

Overall, your investment plan will have a mix of different assets like Indian equity, international equity, debt, and gold. The mix of this asset allocation will depend on your risk profile, which involves assessing how much risk you can take. For instance, you need to find out if you are comfortable with a 20-30% decline in your portfolio. If the answer is yes, you can invest in equity. But if the answer is no, you have to minimize your allocation to equities.

This assessment of how much risk you can take is done by factoring in multiple variables such as your age, income, lifestyle, loans, responsibilities, etc. Determining your risk profile also involves assessing your personality based and how you react to adverse events.

The old school way of risk profiling an investor has been labeling them as Conservative, Moderate, or Aggressive.

Step 4 – Monitoring And Re-balancing

An investment plan is not a one-time thing that you create and forget. After creating the investment plan, you will have to keep tracking your progress towards different goals. From time to time, you will need to weed out the under performing investments and include emerging investment opportunities. You will also need to re-balance your asset allocation from time to time. Otherwise, your investments may digress from the original asset allocation and consequently lead to counterproductive outcomes.

Conclusion

Financial planning is all about designing a trip that gets you safely to your destination. In this blog, we have explained the importance of financial planning. We have also explained how you can go about financial planning with examples. But a financial plan on paper is of no use unless you start acting on it. The earlier you start acting on your financial planning, the less complicated and the higher are the chances of achieving your financial goals. So why the delay?

We hope you found this article useful. If you did, please share it with your friends and family and help us reach more people. If you have any questions or you need clarification on financial planning reach us through email at franchisebiz66 at gmail.com or through www.finservwealth.com

SOURCE: ET MONEY