Mutual Fund Systematic Investment Plan (SIP) is considered a good option for accumulating wealth to attain different goals, including home buying. While you can buy a new house or flat at any time by availing of a home loan, it typically requires you to pay 20% of the property price from your own pocket while the rest of the cost is covered by the bank.

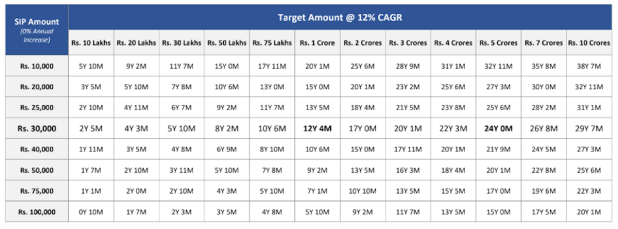

Experts advise that it is always better to keep the loan amount low. To do so, you will need to maximise your savings. Here’s a look a how much time it will take for you to accumulate Rs 50 lakh for home buying through Mutual Fund SIP (assuming 12% returns).

Rs 10,000 SIP: It will take 15 years to get Rs 50 lakh from Mutual Fund SIP if the annualised rate of return is 12%.

Rs 20,000 SIP: It will take 10 years and 6 months to get Rs 50 lakh from Mutual Fund SIP if the annualised rate of return is 12%.

Rs 25,000 SIP: It will take 9 years and 2 months to get Rs 50 lakh from Mutual Fund SIP if the annualised rate of return is 12%.

Rs 30,000 SIP: It will take 8 years and 2 months to get Rs 50 lakh from Mutual Fund SIP if the annualised rate of return is 12%.

Also Read: Way to get your first Rs 1 crore fast from Systematic Investment Plan

Rs 40,000 SIP: It will take 6 years and 9 months to get Rs 50 lakh from Mutual Fund SIP if the annualised rate of return is 12%.

Rs 50,000 SIP: It will take 5 years and 10 months to get Rs 50 lakh from Mutual Fund SIP if the annualised rate of return is 12%.

Funds India Wealth Conversations Report December 2022© Provided by The Financial Express

Rs 75,000 SIP: It will take 4 years and 3 months to get Rs 50 lakh from Mutual Fund SIP if the annualised rate of return is 12%.

Rs 1 lakh SIP: It will take 3 years and 5 months to get Rs 50 lakh from Mutual Fund SIP if the annualised rate of return is 12%.

(The calculation above is based on data provided by Funds India Wealth Conversations Report December 2022)

Disclaimer: Mutual fund investments are subject to market risks. There is no assurance or guarantee that a fund will give 12% or even lower returns. Please consult your financial advisor before investing in any mutual fund scheme)